Viking Fence & Rental Company Can Be Fun For Everyone

Viking Fence & Rental Company Can Be Fun For Everyone

Blog Article

An Unbiased View of Viking Fence & Rental Company

Table of ContentsThe Single Strategy To Use For Viking Fence & Rental CompanyThe smart Trick of Viking Fence & Rental Company That Nobody is DiscussingThe Best Strategy To Use For Viking Fence & Rental CompanyViking Fence & Rental Company for DummiesViking Fence & Rental Company Fundamentals ExplainedThe Best Guide To Viking Fence & Rental Company

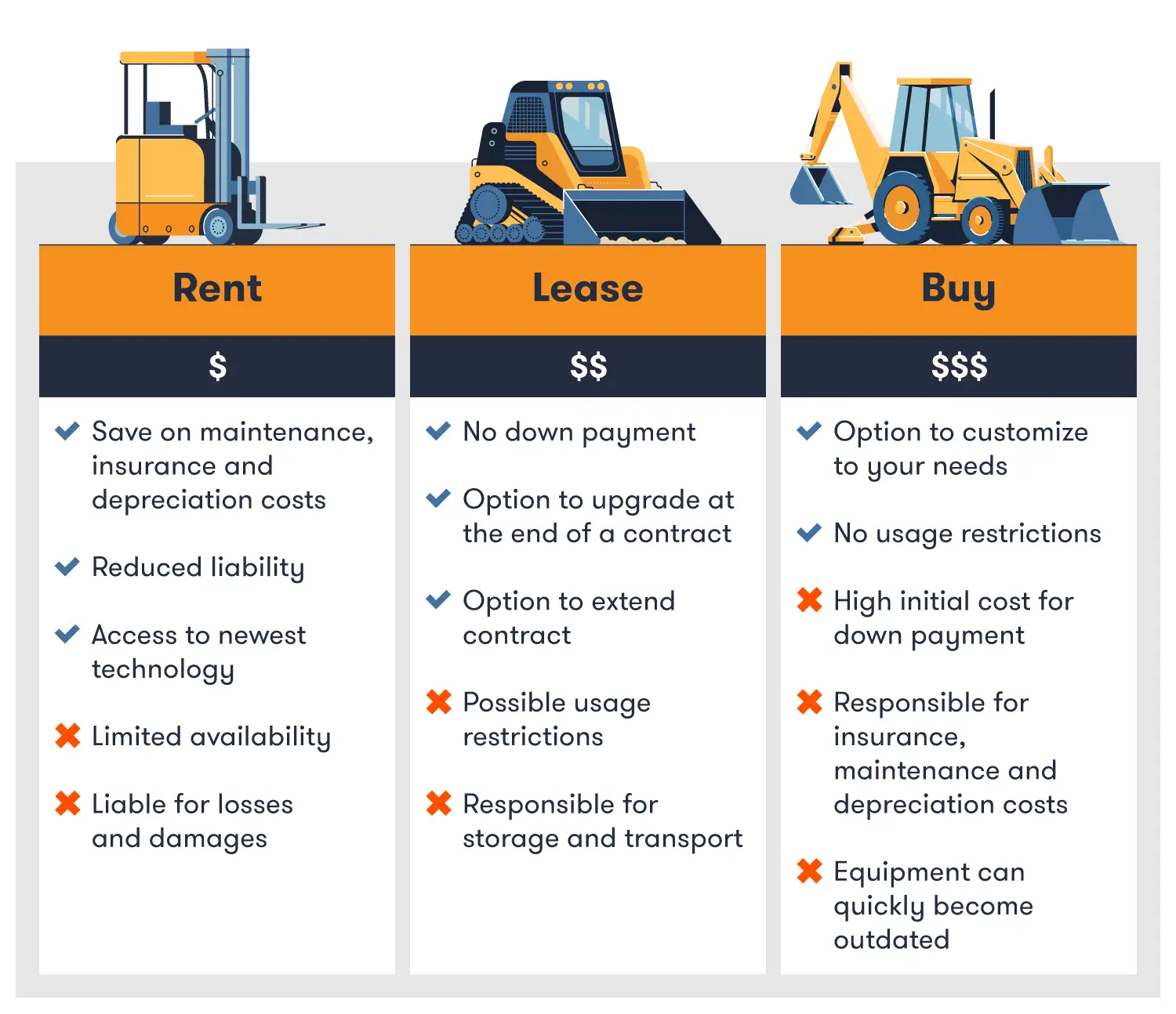

Reference: Areas 6006, 6006.1, 6006.3, 6006.5, 6009, 6010, 6010.1, 6010.65, 6010.7, 6011, 6012, 6012.6, 6016.3, 6092.1, 6094, 6094.1, 6243.1, 6244, 6244.5, 6379, 6390, 6391, 6407, and 6457, Revenue and Tax Code; and Area 1936, Civil Code. (a) Interpretations. (1) Lease. The term "lease" includes service, hire, and certificate. It includes an agreement under which an individual safeguards for a consideration the momentary use tangible personal effects which, although not on his or her premises, is operated by, or under the instructions and control of, the individual or his or her staff members.

Viking Fence & Rental Company for Beginners

( 2) Sale Under a Protection Contract. (A) Where an agreement assigned as a lease binds the "lessee" for a fixed term and the "lessee" is to obtain title at the end of the term upon conclusion of the called for repayments or has the choice to acquire the residential property for a nominal amount, the contract will certainly be pertained to as a sale under a security contract from its creation and not as a lease.

(B) Special Application. Purchases structured as sales and leasebacks will additionally be dealt with as financing transactions if all of the list below demands are met: 1. The first acquisition rate of the home has not been entirely paid by the seller-lessee to the devices vendor. 2. The seller-lessee appoints to the purchaser-lessor every one of its right, title and rate of interest in the acquisition order and invoice with the tools supplier.

Rumored Buzz on Viking Fence & Rental Company

The seller-lessee has a choice to buy the home at the end of the lease term, and the choice price is fair market worth or less - roll off dumpster rental. (C) Tax Obligation Advantage Deals. Tax does not put on sale and leaseback transactions became part of based on former Internal Revenue Code Section 168(f)( 8 ), as enacted by the Economic Recuperation Tax Obligation Act of 1981 (Public Law 97-34)

What Does Viking Fence & Rental Company Mean?

No sales or make use of tax obligation relates to the transfer of title to, or the lease of, tangible personal effects according to an acquisition sale and leaseback, which is a transaction pleasing all of the list below problems: 1. The seller/lessee has paid California sales tax obligation repayment or make use of tax with regard to that person's purchase of the building.

The purchase sale and leaseback deal is consummated on or after January 1, 1991. The sale of the building at the end of the lease term goes through sales or make use of tax. Any lease of the building by the purchaser/lessor to any type of individual besides the seller/lessee would undergo use tax gauged by services payable.

Viking Fence & Rental Company Can Be Fun For Everyone

(B) Linen supplies and comparable write-ups, including such things as towels, attires, coveralls, store coats, dust cloths, caps and dress, and so on, when a crucial part of the lease is the furniture of the persisting service of laundering or cleansing of the articles rented. (C) Family home furnishings with a lease of the living quarters in which they are to be made use of.

A person from whom the owner got the property in a deal explained in Section 6006.5(b) of the Revenue and Taxation Code, or 2. A decedent from whom the owner acquired the residential or commercial property by will or by regulation of succession.

The Main Principles Of Viking Fence & Rental Company

(G) A mobilehome, as defined in Areas 18008(a) and 18211 of the Wellness and Safety And Security Code, apart from a mobilehome originally offered brand-new before July 1, 1980 and not subject to neighborhood home taxation. (2) Leases as Continuing Sales and Acquisitions. When it comes to any kind of lease that is a "sale" and "acquisition" under subdivision (b)( 1) above, the approving of belongings by the lessor to the lessee, or to another individual at the direction of the lessee, is a proceeding sale in this state by the owner, and the belongings of the property by a lessee, or by an additional person at the instructions of the lessee, is a continuing acquisition for use in this state by the lessee, as aspects any time period the rented property is positioned in this state, more info irrespective of the time or location of shipment of the home to the lessee or such various other individuals.

(c) General Application of Tax Obligation. (1) Nature of Tax Obligation. When it comes to a lease that is a "sale" and "acquisition" the tax is determined by the rentals payable. Normally, the suitable tax obligation is an usage tax upon the usage in this state of the home by the lessee. The owner should gather the tax obligation from the lessee at the time services are paid by the lessee and give him or her an invoice of the kind asked for in Policy 1686 (18 CCR 1686).

Report this page